On the Losing Side of a Credit Battle

London, England

Where have all the jobs gone

long time passing

Where have all the jobs gone

long time ago

Where have all the jobs gone

Gone to graveyards everyone

When will they ever return

Oh when will they ever return

– Sung to the tune of “Where Have All the Flowers Gone?”

“Many lost jobs in US will never come back…” says The Wall Street Journal.

Need we explain why? Because they’re not lost, waiting to be rediscovered. They’re not missing in action, to be repatriated after the fighting stops. Instead, they’re dead. Gone forever.

There have been 7.2 million jobs lost since recession began. Many of these jobs were Bubble Age jobs. Millions of people, for example, earned their money in ‘housing.’ They were putting up houses in the sand states…or building granite countertops…or selling, flipping, financing the houses. Those jobs are gone forever. Never again in our lifetimes are we likely to see such an explosion in the housing industry. Sure, people will still build houses…and do all the other work involved in the traditional housing industry. But it will be only a fraction of the industry it was in the 2002-2007 period.

There were also all the jobs involved in selling things to people who didn’t need them and couldn’t afford them. Labor was needed at every step of the way – manufacturing (perhaps in China), shipping, stocking, retailing, fixing, and financing the stuff.

And don’t forget all that mall space…and all the trucks…and all the other things that supported the over-consumption of the Bubble Age.

And now the Bubble Age is over. It will not come back, no matter how much cash and credit the feds pump into the system. (Not that they can’t make things worse…in a BIGGER bubble…but that is not yet in sight.)

In The Wall Street Journal yesterday was an item about Las Vegas. The casinos are folding up their expansion plans, says the WSJ.

But the big news yesterday was that the service industries are growing again…at least that’s what the latest figures show. This news so delighted investors that they bid up Dow stocks 112 points. Oil rose above $70. Gold posted a $13 gain.

Don’t get too excited about that rise in the service sector. Everything bounces…even dead jobs. Dead jobs bounce; they still don’t get up. After months of decline, it may be true that the service industries have had a rebound, but don’t expect them to begin recovering the stamina and strength of the bubble years. A few more people may have gotten jobs serving drinks in Detroit’s bars last month, but it is not likely to turn into a durable recovery of the job market,

In the 1990s, the US economy added 2.15 million new jobs every year. It needed to add at least 1.5 million or so just to remain at full employment – that is, with about 5% of the workforce unemployed at any time.

To put that number in perspective, this year the economy as LOST 2.5 million jobs, just in the last six months. Those jobs aren’t coming back. As we keep saying, this is a depression. It is a major correction, in which the economy needs to find new jobs…because it can’t continue to do what it has been doing.

New jobs are typically created by new businesses – small businesses that are growing. Big businesses already have all the market share they’re going to get. They also typically have all the employees they need. Then, when hard times come, they discover that they don’t need all that they have, so they cut back.

Job cuts from large businesses is what you expect in a recession. But this time it is different. This time, big businesses have let people go by the million. But small business has not been hiring them either. So not only is unemployment growing…the trend shows no signs of coming to an end.

Economists are reconciled to high unemployment levels for a long time. The head of the IMF says unemployment might peak out in 8 to 12 months. Even if that were true, it will be a very long time before the job market recovers. Just do the math.

We’ll keep it simple. The economy needs, say, 1.5 million new jobs per year. Instead, over the last two years, it lost 7.5 million. Now, it has to stop losing jobs…let’s just say that happens a year from now. By then, the total of jobs lost may be near 10 million. Plus, there are the new jobs it needed – but never got – over that 3 year period. That’s another 4.5 million. So, the total will be about 14.5 million jobs down. Then, let us say, because we are in a generous and optimistic mood, that the economy then begins creating jobs again…at the rate it did during the ’90s. What ho! After five years, that still leaves the economy more than 10 million jobs short, doesn’t it?

In order to get back to full employment, the economy has to surprise us on the upside. It has not merely to return to the growth levels of the ’90s…it has to surpass them. It needs to grow so fast it creates 3 million jobs per year. And even then, it would take nearly 10 years to get back to full employment.

Pretty grim, huh?

Well, don’t worry about it. It won’t be like that. It will be worse. Keep reading…

“Uh…Bill…what do you mean, ‘worse’?”

Glad you asked.

In the typical post-war recession, jobs are lost…then they are recovered when the economy gets on its feet again. But this happened in the credit expansion of the ’45-’07 period. Each recession was just a pause, when the economy was catching its breath. Then, it was off again…in the same direction – up the mountain of credit.

This time, it’s not a typical post-war recession. It’s something different. Now, we’ve reached the peak. We’re coming down the other side…wheee! Look out below!

Now we don’t need all those people building houses, stocking the shelves and selling things. We don’t need such a big financial industry either. Now, people want to get rid of credit, not get more.

And the businesses that were goosed up in the credit bubble are now deflating fast. They’re not just taking a break. They’re lining up the jobs and shooting them in the back of the head. Those jobs are gone. (See below…)

In a ‘normal’ recession, jobs reappear because the economy continues in the same direction. In a depression, it changes course. Debts are paid off. Spending goes down, more or less permanently. The economy actually contracts…until consumer debt is once again down at an acceptable level…or a new model for growth can be found.

The Wall Street Journal mentions a statistician who was making $100,000 a year. He too is a victim of depression. His job has been outsourced to India. Businesses, with less revenue coming in the door, must cut costs in whatever way they can. Labor is the single biggest item on most firms’ ledgers. They will reduce it however they can. And once the change is made, there is little chance that the job will come back.

It is a little like a battle. In an attack, troops often get separated. They are ‘lost’ – for a while. Then, the winning side is able to recover its missing troops as it advances. But the losing side gives up its troops forever. They are stuck behind enemy lines and cannot rejoin their units.

We are now on the losing side of a credit battle. Having gained so much ground, and so many jobs, in the advance, the United States is now giving them up.

“I expect over the next several months, mainstream pundits and forecasters will start worrying about tepid hiring, even as the pace of job losses slows,” Strategic Short Report’s Dan Amoss chimes in. “As we ‘lap’ the 2009 corporate cost cutting by early 2010, and top lines fail to rebound, earnings estimates will have to come back down. I’m amazed at how many sell-side analysts are modeling V-shaped recoveries in 2010 earnings. Most stock prices are disconnected from reality.”

And here is a story we foretold years ago. Private equity was mostly a fraud, we said. Sharp operators bought companies for more than they were worth, loaded them with debt, collected huge fees, and then sold them back to the public or to other private equity firms. Come the revolution, we mused, these deals would go bad.

Well, the revolution has come. The deals have gone bad. The New York Times reports:

“Simmons [the mattress company] says it will soon file for bankruptcy protection, as part of an agreement by its current owners to sell the company – the seventh time it has been sold in a little more than two decades – all after being owned for short periods by a parade of different investment groups, known as private equity firms, which try to buy undervalued companies, mostly with borrowed money.

“For many of the company’s investors, the sale will be a disaster. Its bondholders alone stand to lose more than $575 million. The company’s downfall has also devastated employees like Noble Rogers, who worked for 22 years at Simmons, most of that time at a factory outside Atlanta. He is one of 1,000 employees – more than one-quarter of the work force – laid off last year.

“But Thomas H. Lee Partners of Boston has not only escaped unscathed, it has made a profit. The investment firm, which bought Simmons in 2003, has pocketed around $77 million in profit, even as the company’s fortunes have declined. THL collected hundreds of millions of dollars from the company in the form of special dividends. It also paid itself millions more in fees, first for buying the company, then for helping run it. Last year, the firm even gave itself a small raise.

“Wall Street investment banks also cashed in. They collected millions for helping to arrange the takeovers and for selling the bonds that made those deals possible. All told, the various private equity owners have made around $750 million in profits from Simmons over the years.”

A Deflation Story

London, England

“It was at Rome, on the 15th of October, 1764, as I sat musing amidst the ruins of the Capitol, while the barefooted friars were singing vespers in the Temple of Jupiter, that the idea of writing the decline and fall of the city first started to my mind.”

– Edward Gibbon

Warren Buffett famously says that people do not make money by betting against the US economy. But two years ago we decided to take a chance.

“We are short the United States of America,” we announced from the comfort and safety of our headquarters in London. “Sell its stocks. Sell its bonds. Sell its money. Sell its real estate. Sell the equity. Sell the debt. Sell everything.”

What we saw was an over-stretched empire getting ready to snap. But we were also allowing ourselves to be lazy. Rather than deconstruct the capital structure of the world’s largest economy, we decided to sell the whole damned thing.

All Hell broke loose in September 2008. Since then, US stocks have gone down about a third. Real estate too. Unemployment has doubled. Consumer prices are going down at the fastest rate since the ’50s. And the economy is in the worse recession since WWII.

Meanwhile, Americans’ per capita wealth has fallen from $172,000 in September from $212,000 two years earlier. And the UN reports that the quality of life in America has gone down too…from #5 on its list in 2000, it fell to #13 in 2007. No doubt it is below #20 now.

Buffett has lost billions betting on the US economy while our gold positions are handily up; gold was the most profitable major asset over the last ten years.

So you see, we were right; America was a sell two years ago.

And now it is the dollar that is falling. It’s gone down 12% in the last six months – a huge move for a major currency.

“Asia tries to slow dollar fall,” is the lead story in today’s Financial Times.

Today, a buck and forty-seven cents will buy you only 1 euro. Ten years ago, you could have gotten a euro for less than a single dollar. A falling dollar makes imports more expensive, say analysts…raising the cost of living in the homeland. But you wouldn’t know it from walking around on the streets of Miami or Las Vegas. You can get a house at 50% off its price three years ago. As for the breakfast special – for less than 3 euros you can get enough food to kill a Pakistani.

By European standards, America is cheap.

“Europeans again interested in Florida houses,” says a headline in The New York Times.

House prices are down 30% to 50%. The dollar is down about a third too. That makes the United States a bargain.

But is the United States of America about to become even cheaper?

One thing we were wrong about when we issued our ‘sell America’ call two years ago was US debt. Treasury bonds have resisted the general downward trend of things with the stars and stripes on them. Bonds have not gone down; they’ve gone up.

Private households are buying them for their retirements. Banks are buying them for risk-free profits. Speculators are buying them in anticipation of deflation.

David Rosenberg:

“The big story yesterday was the further massive $12 billion decline in outstanding consumer debt in August – the consensus was looking for an $8 billion contraction. This was the seventh month of debt retrenchment in a row. In other words, the tidal wave of the credit collapse continues unabated, and this is the primary reason why bond yields are still in a fundamental downtrend.

“Over the past year, consumers have run down their debt by a record $113 billion (and this does not include mortgages). This is an absolutely epic shift in household attitudes towards credit and discretionary spending.”

Americans are saving. And they’re buying US Treasury bonds. (More below…) But how safe is their money? Is it a good idea to buy US debt now?

On Wednesday, Latvia tried to raise a trivial amount of money. It offered $17 million worth of 6-month bonds. How likely is it that Latvia will default before Easter? We don’t know, but investors judged it not worth the risk. Not only did the bond auction failed, it failed with no bids.

That’s what happens when lenders lose faith in a government. They refuse to lend it money – except at high rates of interest. But the high rates of interest work like a noose on the neck of a cattle rustler. They block the vital flow of oxygen – not to mention breaking his neck.

Note that the US federal government is still functioning like an empire at the peak of its power. The Pentagon is still rustling up trouble all over the world – at a cost of trillions. US government employees are growing more numerous and richer – with twice the annual incomes of the private sector. And the Obama Administration – apparently unaware that the total unfunded debts and obligations of the federal government have soared to nearly $120 trillion – is considering new ways to get rid of cash.

Remarkably, investors still lend the US government money – asking only 4% annual yield on a 30-year loan. As for 91-day money, they practically give that to the feds for free; it sports only a yield of 0.066%.

This will surely be a point of puzzlement for the financial historian of the next century. It is certainly a point of puzzlement for us.

Yesterday, gold hit a new record at $1057. Doesn’t gold go up when inflation rates rise? And don’t bonds go down when inflation goes up?

So why are people buying bonds with such puny yields?

There is a lot of whispering in this market. Gold is trying to tell us something. Bonds are trying to tell us something. The dollar seems to have something on its mind too. Stocks are just babbling.

If gold is trying to signal that inflation is coming, the bond market is not paying attention. Bonds seem to be saying that it is deflation we should be worried about; but the stock market doesn’t seem to hear.

And there’s the dollar. The greenback is in the same choir with stocks and gold, as near as we can tell. They all seem to be chanting about inflation coming back.

But what if they’re all wrong?

Just look at what is going on in Washington, if you can bear it.

The feds have a budget that anticipates inflation and growth. Spending is supposed to remain flat until 2013. Tax receipts, which are no higher today than they were 10 years ago, are supposed to rise, gradually filling in the Grand Canyon of deficits. The number crunchers think we’re headed back to the Reagan years – when the tough-love policies of the Volcker Fed squeezed out inflation and created a real boom. Then, tax revenues rose 9% per year between 1984 and 1989.

How likely is that today? Not very. Instead, what is likely to unfold is a deflation story. Instead of staying flat, federal expenses are likely to rise as one failed stimulus gives way to another failed stimulus. Then, instead of going up, tax revenues will go down…digging an even grander canyon between out-go and income.

Then, or long before, there will be a panic out of bonds, the dollar, stocks – practically everything. Everything goes down!

At this point, the US will be in about the same situation as the Roman Empire as it approached retirement. Expenses kept rising. Rome had to pay the Blackwater-type military contractors of the era…in addition to keeping Roman mobs supplied with food stamps and unemployment benefits…while its tax base fell. Gradually, the empire lost the ability to defend itself.

When Edward Gibbon began his history of Rome’s decline and fall, Roman real estate had probably been in a bear market for at least 1300 years. Rome’s population fell from over a million to under 20,000. Politically, Italy had broken apart more than 1,000 years before Gibbon was born, and it wouldn’t be put back together again until nearly 100 years after he was dead.

It’s far too early to write the story of America’s decline and fall. That job will fall to some future historian, perhaps seated on the ruins of the Lincoln Memorial, wondering how people made such a mess of things.

Our guess is that he will come to the same conclusion we have: Stocks? Bonds? The dollar? Investors should have sold them all!

Peter Schiff Schools Another Harvard Grad on Austrian Economics And Calls The Housing Bubble in 2006

The Consequences of Big Government

By Robert SamuelsonWASHINGTON -- The question that President Obama ought to be asking -- that we all should be asking -- is this: How big a government do we want? Without anyone much noticing, our national government is on the verge of a permanent expansion that would endure long after the present economic crisis has (presumably) passed and that would exceed anything ever experienced in peacetime. This expansion may not be good for us, but we are not contemplating the adverse consequences or how we might minimize them.

We face an unprecedented collision between Americans' desire for more government services and their almost-equal unwillingness to be taxed. The conflict is obscured and deferred by today's depressed economy, which has given license to all manner of emergency programs, but its dimensions cannot be doubted. A new report from the Congressional Budget Office ("The Long-Term Budget Outlook") makes that crystal clear. The easiest way to measure the size of government is to compare the federal budget to the overall economy, or gross domestic product (GDP). The CBO's estimates are daunting.

For the past half-century, federal spending has averaged about 20 percent of GDP, federal taxes about 18 percent of GDP, and the budget deficit 2 percent of GDP. The CBO's projection for 2020 -- which assumes the economy has returned to "full employment" -- puts spending at 26 percent of GDP, taxes at a bit less than 19 percent of GDP, and a deficit above 7 percent of GDP. Future spending and deficit figures continue to grow.

What this means is that balancing the budget in 2020 would require a tax increase of almost 50 percent from the last half-century's average. Remember, that average was 18 percent of GDP. To get from there to 26 percent of GDP (spending in 2020) would require another 8 percent of GDP in taxes. In today's dollars, that would be about $1.1 trillion, a 44 percent annual tax increase. Even these figures may be optimistic, because CBO's projections for defense and "nondefense discretionary" spending may be unrealistically low. This last category covers much of what government does: environmental regulation, aid to education, highway construction, law enforcement, homeland security.

Whatever the case, the major causes of the budget blowout are well-known: an aging population and rapid increases in health spending. In 2000, Social Security, Medicare and Medicaid -- the main programs providing income and health care for the 65 and over population -- totaled nearly 8 percent of GDP. In 2020, CBO projects that will reach almost 12 percent of GDP. But the deeper source of our predicament is a self-indulgent political culture that avoids a rigorous discussion of government's role.

Everyone favors benefits and opposes burdens (taxes). Republicans want to cut taxes without cutting spending. Democrats want to increase spending without increasing taxes, except on the rich. The differences between the parties are shades of gray. Hardly anyone asks the hard questions of who doesn't need benefits, which programs are expendable and what taxes might cover remaining deficits.

What long sustained this system was falling defense spending and routine, though usually modest, deficits. As defense declined -- from 9 percent of GDP in the late 1960s to 3 percent in 2000 -- social spending could rise without big tax increases. Deficits provided extra leeway. But these expedients have exhausted themselves. Deficits have risen to alarming proportions; in a risky world, defense cannot drop indefinitely.

Obama would make matters worse. He talks about controlling "entitlement" spending (mainly Social Security and Medicare) but hasn't done so. He's proposing just the opposite. His health care proposal would increase federal spending. He says he will "pay for" the added outlays with tax increases or other spending cuts, but what people forget is that every penny of this "payment" could be used (and should be) to close the existing long-term deficit -- not raise future spending and taxes.

The latest excuse for avoidance is the economic crisis. True, deep spending cuts or big tax increases would be undesirable now; they would further depress an already depressed economy. But that doesn't preclude action. Changes could be legislated now that would begin later and be phased in -- a gradual increase in eligibility ages for Social Security and Medicare; gradual increases in energy taxes; gradual elimination of some programs. Such steps might improve confidence by reducing uncertainty about huge budget deficits.

There is little appetite for any of this, and so we face the consequences of much bigger government. Certainly higher taxes for future Americans. Probably a less robust economy. The CBO notes that elevated deficits would penalize saving, investment and income, while unprecedented tax burdens could "slow the growth of the economy, making the (government's) spending burden harder to bear." To such warnings, Americans' collective response is: Go away.

Chávez to Iran: How About Some Uranium?

When Venezuela's Mining Minister Rodolfo Sanz walked into a televised Cabinet meeting this week, President Hugo Chávez impishly asked, "So how's the uranium for Iran going? For the atomic bomb." Chávez was joking, but few were laughing outside Caracas and Tehran. Ever since Chávez announced last month that he was seeking Russia's help to develop nuclear energy in Venezuela — and especially since Sanz turned heads a couple of weeks ago by disclosing that Iran is helping Venezuela locate its own uranium reserves — the South American nation and its socialist, anti-U.S. government have become a new focus of anxiety over regional if not global security.

Related

Stories

That suits Chávez's fondness for the international spotlight. Still, security experts say he's flirting with something more serious than anti-yanqui bravado. Chávez, who recently agreed to sell Iran 20,000 barrels of gasoline a day, backs the country's claim that it's enriching uranium only for peaceful purposes. But if the international community decides Iran is making an atomic bomb — something IAEA inspections may determine later this month — it would complicate any Venezuelan plans to export uranium to the country, since it would be widely viewed as aiding and abetting a rogue nuclear-weapons program. "In that event, the world is watching whether Venezuela seems poised to cross any international legal boundaries," says Johanna Mendelson Forman, a senior associate for the Americas at the Center for Strategic and International Studies in Washington, D.C. "But it's still too early to tell what Venezuela is really doing." (Read a story about the negotiations over Iran's nukes.)

A recent intelligence report put out by the government of Israel, which considers Iran's nuclear program a direct threat to its security, said Venezuela was already supplying Iran with uranium. But experts say it's hardly certain Venezuela even has much, if any, uranium to provide Iran or anyone else. Officials there have long estimated the country is sitting on 50,000 tons of the radioactive ore, concentrated mostly in western Venezuela and in the Roraima Basin along the country's southeastern border with Brazil and Guyana. (The U.S. has uranium reserves of about 340,000 tons.) It may be high grade, says James Otton, a uranium-resources specialist at the federal U.S. Geological Survey, a reference not to its quality but to the "tremendous quantities of uranium in a given volume of rock" found in places similar to Roraima, a virtual Lost World of Precambrian geology.

But those jungle conditions make extracting the ore, if it's there, difficult. "And there is still no publicly available information that uranium has ever occurred in Venezuela," says Otton. "Right now it's just potential." Robert Rich, a Denver-based uranium expert, agrees: "Chávez can claim the geology indicates they might discover it there, but as a scientist I'd say there's not much to it yet."

Sanz, however, insists that Iranian experts have concluded Venezuela "has a lot of uranium." If so, the other big question is whether Venezuela itself will really pursue a nuclear-energy program. Like oil-rich Iran, it's hardly in urgent need of nuclear power: Venezuela has the western hemisphere's largest crude reserves, and 75% of its electricity is hydro-generated. It abandoned its one test nuclear reactor 15 years ago. Still, Chávez says the country needs alternatives, and has struck a deal to receive nuclear-fuel-technology aid from Russia, Venezuela's top arms supplier. "We're not going to make an atomic bomb," Chávez said after announcing the Russia agreement, "so don't bother us the way you're bothering Iran."

Experts say it could take Venezuela's less-than-stellar science infrastructure more than a decade to develop a nuclear-power industry, let alone a nuclear bomb. (Only Brazil, Argentina and Mexico produce nuclear power in the region.) What's more, Venezuela is a signatory to the 1967 Tlatelolco Treaty, which prohibits the development of nuclear weapons in Latin America. Even so, says Mendelson, "the U.S. is worried that Venezuela has become a platform for the entrance of Iranian mischief in the hemisphere." If Iran is building a bomb, she adds, the U.S. may well assume that Tehran is interested in slipping that technology to Venezuela as well.

All that is speculation at this point, of course, and Venezuela would face isolation not just from the U.S. but from its Latin trade partners — especially Brazil, which is campaigning for a permanent seat on the U.N. Security Council — if it were to ever toy with nuclear weaponry. As it is, Chávez can look forward to stepped-up global pressure if Iran, like North Korea, is eventually found to be pursuing a nuclear bomb, especially if international economic sanctions are imposed on Tehran. If that happens, Chávez has indicated he'll ignore the measures and keep supplying the 20,000 barrels per day of gasoline to Iran, which has to import almost half its gasoline because of a lack of refineries.

Then again, it's uncertain if powers like Russia and China, which sell even larger quantities of gasoline to Iran, would take part in U.S.-led sanctions themselves. Their postures are a reminder that when it comes to thwarting Iran's nuclear ambitions, Venezuela may be a small concern in comparison. But given the tensions involved at the moment, few besides Chávez are finding humor in it.

A Russian alliance in Afghanistan?

The Red Army showed us what doesn't work

One of the worst ideas we have heard recently regarding Afghanistan is to bring in the Russians. NATO Secretary-General Anders Fogh Rasmussen suggested that 20 years after the Soviet Union's defeat there, Moscow now might hold the key to victory. "Russia could provide equipment for the Afghan security forces," Mr. Rasmussen said. "Russia could provide training. We could explore in a joint effort how we could further Russian engagement." A moment of clarity is in order.

The Soviet Union fought a 10-year counterinsurgency in Afghanistan that became one of the gravestones of the Evil Empire. The brutality of that conflict is legendary. A member of the Afghan National Security Council staff pointed out to The Washington Times the most obvious legacy of the Soviet war in Afghanistan: "close to a million dead, and many more injured." It's not a memory that NATO should revive.

The Soviet effort in Afghanistan was never viewed as legitimate by the Afghan people. This is the most important distinguishing characteristic between the Soviet war and the current conflict. For all the talk of the Karzai government's image being hurt by irregularities in the recent election, it is nothing compared to the hatred aimed at the communist government installed by force by the Red Army in 1979. This was the original sin of the Soviet war, a contradiction they could never overcome. Regardless of their fortunes on the battlefield, the illegitimacy of the regime they backed made victory impossible.

Russian involvement in the current conflict would be a public-relations gift to the Taliban, whose senior leaders got their first taste of guerrilla war fighting the Soviets and for whom that conflict is central to their heroic myth. A combined NATO/Russian effort would destroy what remains of Western legitimacy in the nation-building effort. "People as a whole separate the West from the Russians," our Afghan source told us. "The U.S. and Europe helped them against the Soviets and regard them as old friends." If NATO and the Russians join forces, "the Taliban can say they are the same and remind people how the Russians treated the Afghans, trampled their religion and their traditions. These are very bad memories."

Russia already gives the coalition overfly rights to supply the conflict, and it could play a role in supplying aid money and logistical support. Moscow is also interested in stemming the tide of narcotics that flows north from Afghanistan's poppy fields. But the most useful role Russia could play is providing examples of what not to do in Afghanistan. Zamir Kabulov, Moscow's outgoing ambassador to Kabul, recently noted that the United States is repeating some of the critical errors the Soviets made, including "neglect of the population, failure in establishing firm cooperation with local communities, [and] leaving them at the behest of the enemy."

During their Afghan war, the Soviets chose only to defend the cities and abandoned the countryside to the guerrillas, making periodic forays when necessary. Those in this country who are advocating a similar approach, hunkering down in strong points and relying on unmanned Predator drones to keep terrorists in check, would do well to examine the Soviet experience. It did not have a happy ending.

several sources

Lenin Peace Prize

"The International Stalin Prize or the International Stalin Prize for Strengthening Peace Among Peoples (renamed the "International Lenin Prize for Strengthening Peace Among Peoples" as a result of destalinization) was the Soviet Union's equivalent to the Nobel Peace Prize. It was awarded by a panel appointed by the Soviet government, to notable individuals whom the panel indicated had "strengthened peace among peoples"."

http://en.wikipedia.org/wiki/Lenin_Peace_Prize

____________________________________________

Black Panther, communist radical, Angela Davis is a recipient of the "Lenin Peace Prize".

From David Horowitz's FrontPageMag.com/DiscoverTheNetworks.org:

PROFILE: ANGELA DAVIS

* Communist professor at the University of California’s Santa Cruz campus

* Recipient of the Lenin “Peace Prize” from the police state of East Germany in 1979

* Provided an arsenal of weapons to Black Panthers who used them to kill a Marin Country judge in a failed attempt to free Davis' imprisoned lover, Black Panther murderer George Jackson

* Icon of the campus Left and frequent guest speaker at anti-war rallies

* Leader of a movement to free all criminals who are minorities claiming that they are political prisoners of the racist United States

* “The only path of liberation for black people is that which leads toward complete and radical overthrow of the capitalist class.”

Angela Yvonne Davis is a tenured professor in the “History of Consciousness” program at the University of California - Santa Cruz. A former member of the Black Panther Party, she is currently a “University Professor,” one of only seven in the entire California University system, which entitles her to a six-figure salary and a research assistant. This income is supplemented by speaking fees ranging from $10,000 to $20,000 per appearance on college campuses, where she is an icon of radical faculty, administrators, and students. Davis has also taught at UCLA and the State University of New York at Stony Brook.

http://www.discoverthenetworks.org/individualProfile.asp?indid=1303

____________________________________________

Portrait of Angela Davis by Obama icon artist Shepard Fairey:

Angela Davis

Source: The Jonathan Levine Gallery (link given above)

Also here:

Angela Davis by Obey Giant, Shepard Fairey:

http://www.zimbio.com/Shepard+Fairey/articles/63/Angela+Davis+Obey+Giant+Shepard+Fairey

____________________________________________

Also by Shepard Fairey, Obama's personal icon artist...

http://www.duckywaddles.com/Scripts/prodView.asp?idproduct=171

____________________________________________

http://www.duckywaddles.com/Scripts/prodView.asp?idproduct=744

____________________________________________

"Stalin Lenin", Shepard Fairey,

limited edition silkscreen, signed

and numbered. 18"X24" *SOLD OUT*

Source: http://www.duckywaddles.com/scripts/prodView.asp?idproduct=429

____________________________________________

From Barack Obama's official website:

“I wanted to make an art piece of Barack Obama because I thought an iconic portrait of him could symbolize and amplify the importance of his mission. I believe Obama will guide this country to a future where everyone can thrive and I should support him vigorously for the sake of my two young daughters. I have made art opposing the Iraq war for several years, and making art of Obama, who opposed the war from the start, is like making art for peace. I know I have an audience of young art fans and I’m delighted if I can encourage them to see the merits of Barack Obama.”

-Shepard Fairey

____________________________________________

From Shepard Fairey's official website (ObeyGiant.com):

Check it out! I got a thank you note from Barack Obama. If he is elected, maybe I have a get out of jail free card. All kidding aside, I’m honored to be acknowledged by someone so important to the future of our country. Also, the Obama campaign asked me to do a poster illustration for sale on their site. It should be out next week on barackobama.com.-Shepard

http://obeygiant.com/post/check-it-out

________________________________________________________

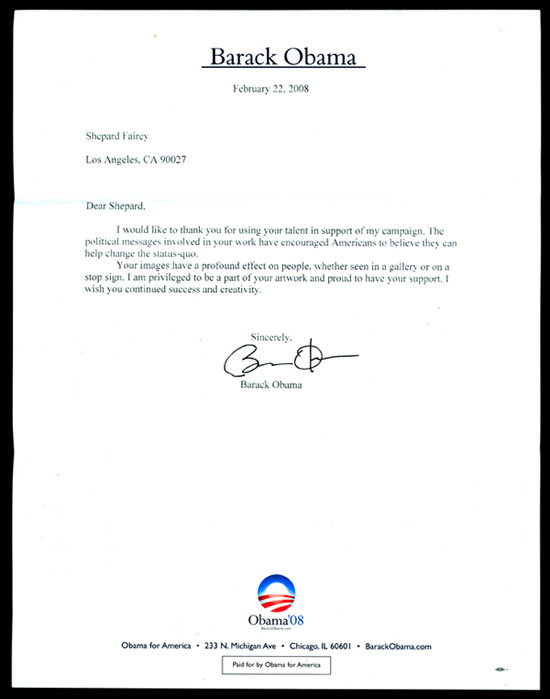

Here is the 'thank you' letter Barack Obama sent to Shepard Fairey:

"Dear Shepard, I would like to thank you for using your talent in support of my campaign. The political messages involved in your work have encouraged Americans to believe they can help change the status quo. Your images have a profound effect on people, whether seen in a gallery or on a stop sign. I am privileged to be a part of your artwork and proud to have your support. I wish you continued success and creativity.

Sincerely, Barack Obama.'"

http://www.washingtonpost.com/wp-dyn/content/article/2008/05/16/AR2008051601017.html

Source for letter image: Fairey's own website (ObeyGiant.com):

http://obeygiant.com/post/check-it-out

If the image of the letter should 'vanish' from Fairey's website, try this link:

http://www.notcot.com/images/obama_letter-to-shepard-fairey.jpg

________________________________________________________

Street artist Shepard Fairey, who designed Obama 'Hope' poster, arrested for graffiti in Boston

[...make that *14* arrests!]

NY Daily News | February 7th 2009

Nobel Committee Rescinds Peace Prize to Obama, Gives Award to Runner-Up

OSLO, October 9 – FOR IMMEDIATE RELEASE – In an update, the Nobel Peace Prize Committee has announced they have rescinded their awarding of this year’s prize to United States President Barack H. Obama. The Committee took this action in responding to criticism that their website states the deadline for Peace Prize nominations was February 1, 2009, which gave Obama less than two weeks in office before being nominated. Accordingly, the Committee has decided to give the award to its runner-up – US Representative Charles Rangel of New York.Nobel Prize an 'A' for Effort, Could Help Pres. With Health Care

CNN’s White House correspondent Dan Lothian saw nothing but pluses for President Obama’s reception of the Nobel Peace Prize on Friday’s American Morning. Lothian guessed that “the President obviously is getting an ‘A’ for effort here,” and even went so far to speculate about whether the reward could help the Democrat “push through on...health care as well...so this could help him.”

CNN’s White House correspondent Dan Lothian saw nothing but pluses for President Obama’s reception of the Nobel Peace Prize on Friday’s American Morning. Lothian guessed that “the President obviously is getting an ‘A’ for effort here,” and even went so far to speculate about whether the reward could help the Democrat “push through on...health care as well...so this could help him.”

Anchors Kiran Chetry and John Roberts turned to the correspondent right out of the gate at the beginning of the program at 6 am. Chetry asked if there had been any official reaction from the White House at that early hour, and Lothian confirmed that the administration hadn’t released any statement at that point. He continued that “two things came to mind when this shocking announcement was made. First of all, that the President obviously is getting an ‘A’ for effort here. The President has made overtures and talked about, since he was running for president, that he wanted to be one who would engage in dialogue.” The White House correspondent cited the Obama administration recent work with Iran and the President “trying to get both the Israelis and the Palestinians to jump-start the peace process there.”

Lothian continued with some of the administration’s own talking points on foreign policy:

LOTHIAN: The other factor as well- and this is something that we hear from the White House time and time again- any time there are polls that come out that shows the favorability ratings of the U.S. on the rise around the world, they’ll e-mail those to us. And so there’s this real sense from the White House here that the President has been able to change the tone and the way that the Americans are viewed around the world, from ones of being bullies pushing the rest of the global community around, to one who says- listen, let’s sit down- let’s talk together- there’s a partnership here. So there’s a sense that that’s one of the factors involved here- the President changing the tone of how people view the United States around the world, and then also the President making these efforts towards peace- being willing to sit down, have some dialogue with countries like Iran.

Later in the segment, Chetry commented that “it’s also interesting about whether it ratchets up the pressure- you know, on this President and on this administration to get something done because of the fact that this prize was awarded.” This is where Lothian’s bizarre speculation about the Nobel Prize’s effect on the health care issue came in:

LOTHIAN: That’s true, but on the other hand, it could also help him. I mean, this -the White House has been beaten up most recently over- you know, what to do next in Afghanistan- Republicans and both Democrats pushing this administration about whether additional troops should be sent in or whether it should be a more focused approach in Afghanistan. Perhaps, this could be something that helps this administration not only push through on the front in Afghanistan, but also- you know, health care as well- a lot of hurdles involving health care. And so perhaps this is something that the administration can use to say- hey, listen- you know, in the world community, the President has some juice here, so this could help him.

Five hours later at the top of the 11 am Eastern hour of CNN’s Newsroom program, the White House correspondent repeated some of his points from American Morning to substitute anchor Don Lemon, who clearly has a similar mindset:

DON LEMON: I’m going to bring in our White House correspondent Dan Lothian, awaiting the President’s remarks- Dan, good to talk to you today- quite an interesting choice and very early on in- in a presidency. He’s not the first one, but this is pretty fast.DAN LOTHIAN: He’s the first one to get this award so early in his presidency. I mean, typically, when presidents get this, it would be in the case of President Carter- long after he left office, or other presidents after they have signed some kind of accord or some peace agreement ends a conflict. But in this case, this is a president who- at least to the committee that awarded him the Nobel Peace Prize- saw a lot of promise. Essentially, he has- he’s a president in progress and he has already at least, according to the administration, started changing the tenor and the tone of how the U.S. is viewed overseas- from- from an administration- perhaps in the past, they believe- that used to only use a hammer to bully around- you know, other world leaders, to an administration, at least according to the White House, that is now decided to sit down and have some dialogue with some of these difficult countries, such as Iran and North Korea. And so it is unusual to- to see a president receive this kind of honor so early in his presidency, but that’s exactly what happened, and the White House pointing out that they were also taken by surprise.

LEMON: You know, this is- and some say that- you know, this is support really from the international community because the international community wants peace and it appears in all of his rhetoric, as you have been saying- all of his speech [sic], and even before he became president- that he spoke up for peace and for speaking to allies and enemies as well, to try to bring some peace throughout the world. Is that correct? Is this a message, you think, from the international community possibly?

LOTHIAN: Well, you know- perhaps- perhaps that’s correct, and- you know, as you pointed out, this is something that President Obama has been pushing even before he became president, and was criticized by his now-Secretary of State Clinton for talking about wanting to have a dialogue with Iran without preconditions. So- you know, and we’ve seen now for the first time at the P-5 plus 1 meetings in Geneva recently, where the United States and Iran not only engage with each other, but agree to have additional talks with these other world leaders as well in the future. So certainly this is something the administration has been pushing for long before the President came into office, and it certainly got noticed.

You heard it hear first- CNN thinks President Obama earned the Nobel Peace Prize for his “soaring rhetoric” for peace dating back to his presidential run, and that this development will help him with the health care issue.

—Matthew Balan is a news analyst at the Media Research Center.

No comments:

Post a Comment