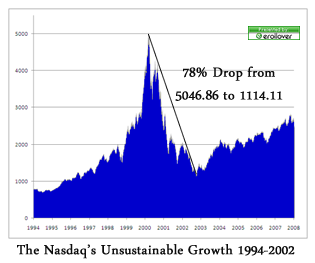

Great Stock Market Crashes | The Dot-Com BubbleBy Mike RowanThe Dot Com and NASDAQ Crash of 2000When: March 11, 2000 to October 9, 2002Percentage Lost From Peak to Bottom: The Nasdaq Composite lost 78% of its value as it fell from 5046.86 to 1114.11. The Dot-Com crash seems like a fleeting memory, however, it was responsible for the destruction of untold personal wealth. Having been a broker at a major Wall Street firm at the time, it was a period of tremendous excitement, hot IPO’s, and the mentality that defied conventional logic. As with many stock market bubbles, greed was the underlying factor that contributed to this period of stock market history. What was the Dot-Com Bubble?The "dot-com bubble" (or sometimes the "I.T. bubble") was a speculative bubble covering roughly 1998–2001 (with a climax on March 10, 2000 with the NASDAQ peaking at 5132.52) during which stock markets in Western nations saw their equity value rise rapidly from growth in the more recent Internet sector and related fields.The period was marked by the founding (and, in many cases, spectacular failure) of a group of new Internet-based companies commonly referred to as dot-coms. Companies were seeing their stock prices shoot up if they simply added an "e-" prefix to their name and/or a ".com" to the end, which one author called "prefix investing". A combination of rapidly increasing stock prices, market confidence that the companies would turn future profits, individual speculation in stocks, and widely available venture capital created an environment in which many investors were willing to overlook traditional metrics such as price to earnings ratios in favor of confidence in technological advancements. The Dot-Com era was similar to other periods in Stock Market HistoryCompanies underwent a similar phenomenon to the one that gripped Seventeenth century England and America in the early eighties: investors wanted big ideas more than a solid business plan.Buzzwords like networking, new paradigm, information technologies, internet, consumer-driven navigation, tailored web experience, and many more examples of empty double-speak filled the media and investors with a rabid hunger for more. The IPOs of internet companies emerged with ferocity and frequency, sweeping the nation up in euphoria. Investors were blindly grabbing every new issue without even looking at a business plan to find out, for example, how long the company would take before making a profit, if ever. The Dot-Com Bubble BurstsObviously, there was a problem. The first shots through this bubble came from the companies themselves: many reported huge losses and some folded outright within months of their offering. Siliconaires were moving out of $4 million estates and back to the room above their parents' garage. In the year 1999, there were 457 IPOs, most of which were internet and technology related. Of those 457 IPOs, 117 doubled in price on the first day of trading. In 2001 the number of IPOs dwindled to 76, and none of them doubled on the first day of trading.It soon became readily apparent that Wall Street had strayed from conventional wisdom, and as the poor numbers started to come in, investors started to wonder if these businesses were sustainable. All of the sudden, companies with real business plans and revenue streams started to look more attractive to investors. As this effect snowballed, the investing herd had a sudden flight to quality, resulting in the rapid acceleration of stock market losses. Dot-Com Lessons to be LearnedIn hindsight, this crash was caused by the “irrational exuberance” of companies, Wall Street, and individual investors alike. We can all learn a lesson from the Dot-Com bubble. Companies must have a solid business strategy, a revenue model, and a tried and true management team. Nobody is a billion dollar company overnight, and if something seems too good to be true, then it deserves even more scrutiny than normal. |

Tuesday, September 8, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment